An NRI’s Go-To Guide on How To Buy Real Estate in India Hassle-Free

If you are an NRI and the thought of buying real estate in India is doing rounds in your head, then you must know that there is no time better than the present to do so. The real estate market has opened up to the NRI real estate investors/buyers. According to the Foreign Exchange Management Act regulations, the NRO buying real estate in India is under no obligation to involve the RBI, take special permissions from it, or even inform it of the decision at the final stage of the purchase. However, things aren’t just as black and white, unfortunately. So, if you are NRO interested in buying real estate in India, here’s a comprehensive guide which will help you pan your way into it:

WHAT WE DO

The Type of Property an NRI Can Invest In

There are certain laws which restrict the NRI from buying agricultural land, farmhouses, and plantations. The land has to be included under the category of commercial property or residential property . However, exceptions can be made when the RBI takes into account such cases individually after a plea has been made to them by the buyer regarding the same.

Keeping a Check

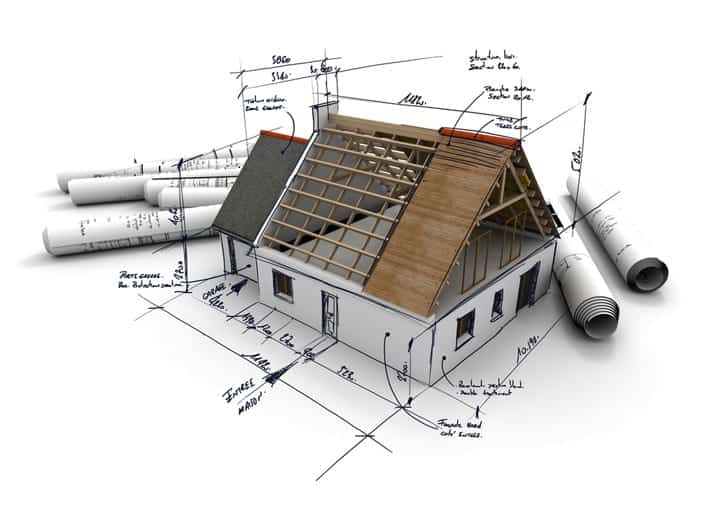

What happens when the buyer cannot be physically present at the spot of the purchase is that the chances of a mishap, big or small, get increased. Hence, firstly, ensure that the property you are buying (if it is commercial) is located at a favourable geographic location which make the purchase beneficial. When it comes to residential properties, it is advised to invest in a credible builder who as a positive reputation in the industry. This is to ensure that even in your physical absence, your residence is being constructed by the best, using the best.

Tax Implications of the Purchase

Probably the biggest obstacle, and the most disappointing one, you can face after you have set your mind on a property and made financial arrangements of the purchase, is that of documents. Every piece of document is absolutely indispensable and you should have it all ready. You’ll need:

- Indian Passport or Overseas Citizen of India (OCI) card

- PAN Card

- Power of Attorney Certificate

Tax Implications of the Purchase

Like every other purchase, real estate is also taxable for NRIs (as well as indian citizens) in the country. NRIs are granted the same tax benefits as the Indian citizens. You need to be well-acquainted with the tax implications of the purchase. If the property is for self-use (which means it is the only one you own in the country), you can claim a maximum of INR 1.5 lakh deduction on the interest payable on the home loan (if applicable). The regulations or a property on rent are, however, different.

You can find out all about such and much more extremely significant information before you go ahead and sign the final document of the deal on reliable websites such as sobha.com.