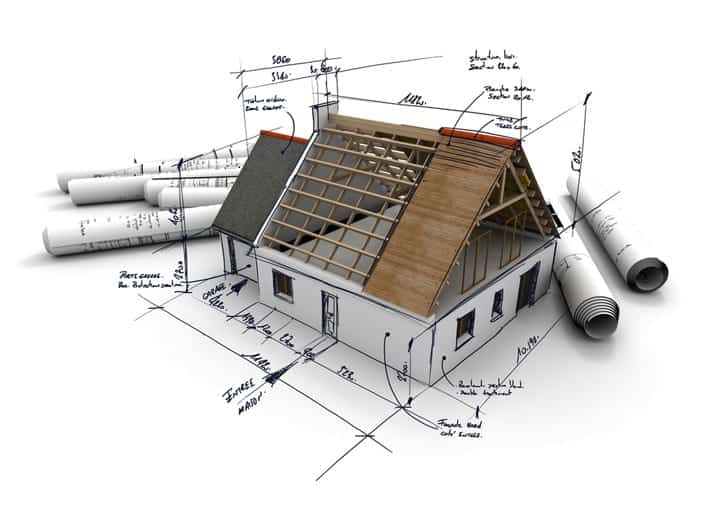

HOUSING LOANS? CAREFUL!

Investment in housing is the biggest investment in one’s life.It is imperative to select a suitable house but it is also very important to arrange finance for it.Many Banks are coming forward to lend housing loans with many attractive schemes with different periods of repayment, and various interest rates.While availing loans from Banks or any financial institutions or NBFCs one should keep following points in mind

As per recently changed housing loan conditions eligible citizens can avail a loan up to Rs 35 lakhs for a housing unit costing Rs 45 lakhs in urban areas and Rs 25 lakhs for a housing unit of Rs 35 lakhs in rural areas.Borrowers are eligible for discounts in interest rates under Pradhan Mantri Avas Yojna.

Eligibility: Normally financial institutions consider following points for sanctioning the loan. Here there are:

Take home Salary / income after meeting all the deductions such as instalments on existing loans, income tax, PF etc. Proof to be submitted are Salary slips, Income Tax returns and latest Bank A/C statements, one of the important criteria Banks consider is credit score awarded by credit bureau companies such as CIBIL.

Loan to Value Ratio ( LTV ) : Value of the property is important to arrive at maximum eligible loan amount

If the required loan amount is less than 30 lakhs 90% of value of the property is sanctioned as maximum loan. If the loan amount is 30 to 75 lakhs 80% of the property value is taken as maximum eligible amount. If the required loan amount is 75 lakhs and above 75% of the property value is taken as maximum eligible loan amount.

Before availing loans from Banks or any other Financial Institutions following have to be kept in mind. They are:

- Rate of Interest

- Processing fee.

- Valuation fee

- Legal opinion charges

- Other charges if any.

- How fast loan applications are processed.

For under construction buildings loans are disbursed in stages as per the progress in construction. Be careful & act wisely while investing on your future assets.

Leave Your Comment